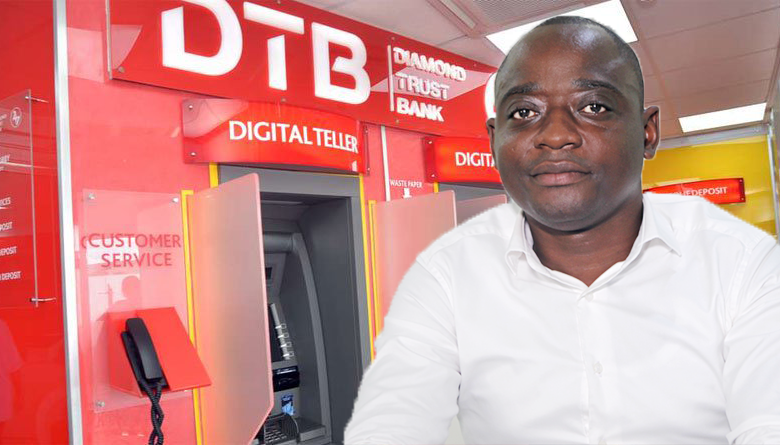

The Court of Appeal will make a judgment on Monday, November 2 to determine whether Diamond Trust Bank, DTB, refunds an equivalent of Sh120 billion shillings to businessman Hamis Kiggundu.

The ruling will also shed more light as to whether the loans Kiggundu took from DTB Uganda and DTB Kenya qualified to be termed syndicated loans.

Kiggundu, through his two companies, Kiggs International and Ham Enterprises, took six credit facilities worth about Sh40 billion over six years, from DTB Uganda and DTB Kenya in different tranches. As he continued paying, he decided to consolidate the credit facilities into one loan.

He later accused the banks of continuing to take out of his accounts more than what he owed them and also claimed that DTB Kenya was illegally operating in Uganda since it was not licensed by Bank of Uganda.

He says they had so far taken Sh120 billion Shillings, from his accounts in DTB Uganda, to pay what he owed DTB Kenya. The high court agreed with him that DTB’s actions were illegal and that it should refund the money.

This immediately drew the response of the Uganda Bankers Association which called the credit facilities taken by Ham, a syndicated loan.

Syndicated loans are a basket of loans raised in one arrangement, by two or more banks, for a client, and are usually larger than the ordinary loans given out by Commercial banks.

It can be by local banks, foreign banks, or a partnership between local and foreign banks.

Legal and financial experts who disagree with the ruling argue that Ham’s credit facilities were a syndicated loan and that therefore this ruling is likely to be a warning to banks to stay away from syndicating loans.

They say it might also prompt other borrowers of such loans, to file similar suits to evade repayments. This would put the loan syndication business in Uganda, at a risk. Currently, about 5.7 trillion Shillings worth of loans in Uganda are syndicated.

The government is the main beneficiary of syndication, with loans like the 703 million dollars raised by several banks for the Bujagali Hydropower Project in 2007.

The private sector has also benefitted, notably, in 2009, 2016 and 2020, MTN Uganda has raised three syndicated loans of 100 million dollars each mainly from local banks to expand it’s network and recently to finance the renewal of its license.

Back to the Ham vs DTB case, another side of experts say this was not a syndicated loan, but that DTB Kenya agreed to give new credits to Ham when DTB Uganda failed to raise the amounts the businessman was asking for, at separate instances. This, according to them, disqualified them as a syndicate.

Ham’s lawyer, Fred Muwema, dismisses the threat to the loan syndication business as farfetched, saying that even if it was a syndicated loan, it is the errant bank, in this case, DTB, which is being penalized, not all banks that have participated in syndications.

The Central Bank of Uganda, in pronouncing itself on the ruling, stated that a foreign bank does not have to ask for a BOU license to conduct commercial banking business in Uganda, provided it is not lending from the deposits taken from Ugandans

This raised more questions on the Bank of Uganda’s role in regulating financial inflows, and why Ugandan banks would ask for help abroad to meet a loan request of 40 billion shillings in six years.

Uganda Bankers Association Chief Executive Wilbrod Owuor says a collective raising a loan facility guarantees greater security as the risk of defaulting is shared by the several banks in the deal. It is also a fact that Uganda has some of the highest loan interest rates in the region averaging 20 per cent, despite persistent calls by the BOU for lower rates.

The banks say high-risk levels of Ugandan borrowers, the cost of operations especially in the countryside, as well as expensive sources of money for lending are responsible for this. The central bank’s mandate also extends to controlling money in circulation, including money coming into the economy from foreign sources.

According to financial consultant Clyde&Co, it is standard practice for all private-sector loans to be registered with the central bank, to be able to control money in circulation, control inflation, and foreign exchange rates.