The dfcu Bank misery is not about to end, the commercial institution has announced they’re shutting down 22 branches housed in Meera Investments Ltd buildings, the estate development arm of Rupaleria Group of companies.

dfcu Bank whose public image is under close scrutiny since taking over Crane Bank Ltd in 2017, was ordered to vacate the buildings owned by the former’s landlord Meera Investments Ltd after it emerged that the bank was misled by city Law firm Sebalu & Lule Advocates to transfer title properties. The law firm has since been banned from representing dfcu Bank in the dispute after being found guilty of conflict of interest.

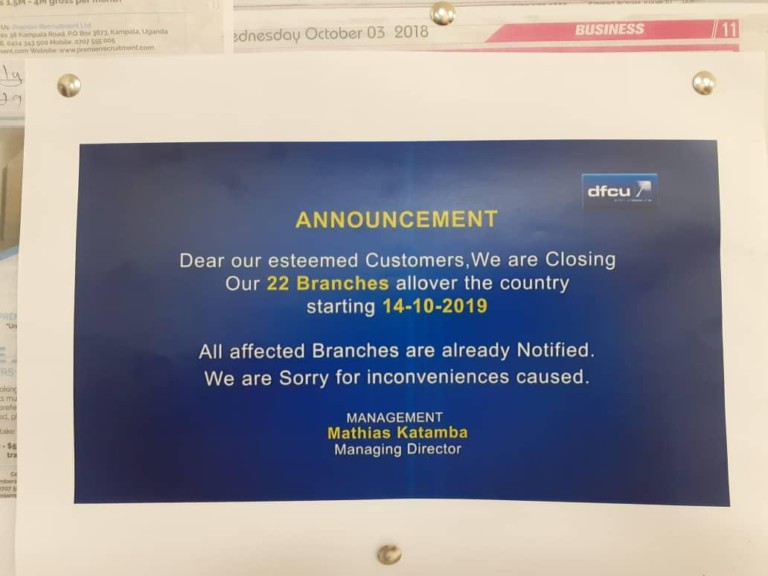

In a public notice, a copy of which this website has seen, Managing Director Mathias Katamba noted that 22 branches will be closed not later than October 14, 2019.

Mr. Katamba who replaced Mr. Juma Kisaame, who left following the spotlight in the controversial transaction, that invited shareholder trouble for the institution also confirmed that the bank has asked firms to provide “architectural and project management consultancy services to support relocation of 22 selected business locations across the country.”

This website recently reported that leaked documents indicated that Sebalu & Lule Advocates who were recently barred by the High Court from representing the same bank against city tycoon Sudhir Ruparelia for being conflicted misled the dfcu Bank to transfer leasehold titles from Crane Bank Ltd during the controversial takeover two years ago.

The document titled Transfer of former Crane Bank household properties, dated May 8, 2017, exposed the fraudulent transfer of land tittles that belonged to Sudhir’s Meera Investments Ltd as BoU handed the disputed properties to dfcu Bank without legal authority.

Acting on ill advise of Sebalu and Lule, dfcu Bank transferred the properties to their names before the case could be disposed of, an act that invited serious trouble for the bank.

“In light of the lengthy of time between the completion of date and when dfcu Bank can vividly exercise the option to rescind the purchase of household properties, our recommendations is that the transfer be registered immediately,” reads an excerpt from the document.

ndustry experts then argued that the whole procedure was entangled with fraud as there was no consent from the Landlord (Meera Investment Ltd) before transferring the lease to another party.

Experts also wondered how ‘senior’ lawyers like Sebalu & Lule Advocates could have ignored such a very important aspects of law, causing dfcu massive losses in billions of shillings.