Uganda Revenue Authority (URA) has penalized a one Ntwari Bernard for concealment of goods under section 202 of the East African Community Customs Management Act (EACCMA).

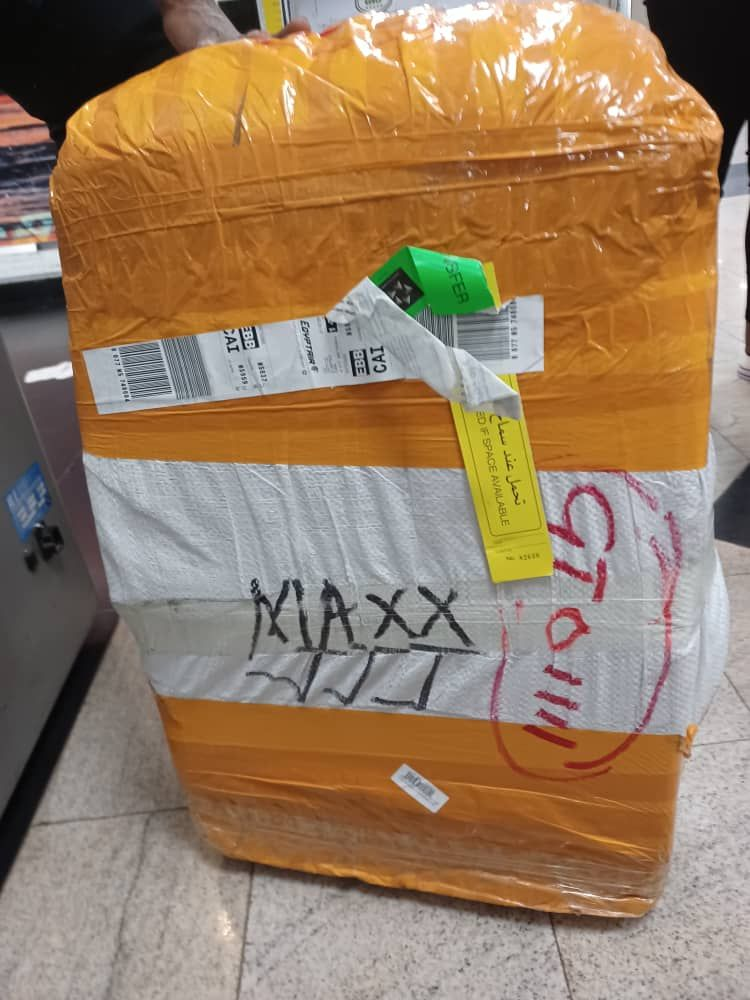

The importer was penalized UGX 10,289,580/= for concealing smart phone spare parts in two box speakers that arrived through Entebbe Airport on 3rd April 2023.

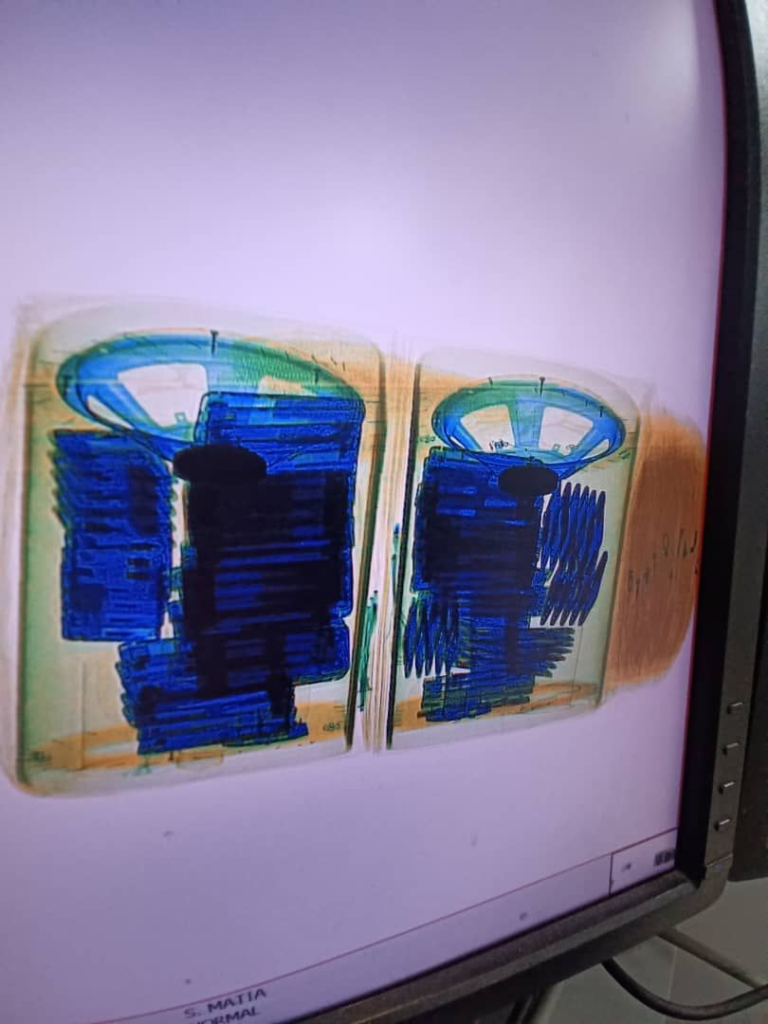

In April, a traveller abandoned a package at a conveyor belt and upon a non-intrusive inspection, it was revealed the box speakers contained concealed smartphones. However, when Ntwari, the owner surfaced to claim his goods, URA carried out a physical verification and it was found that the goods were spare parts of iPhone and Samsung phones.

Ag. Manager Entebbe Customs Esunget Simon explained that the package which was in the names of “LIU” was at one time claimed by a one Joshua, who could not prove ownership of the goods.

“Later, Ntwari Bernard approached us to claim the goods, but we told him to produce LIU in vain. The importer had to swear an affidavit with Uganda Registration Services Bureau to provide a legally binding statement verifying his ownership,” he said.

Esunget added that on top of payment of the penal tax, Ntwari also paid taxes of UGX 7,750,284/= for the spare parts of the iPhone and Samsung phones.

Assistant Commissioner Public and Corporate Affairs Ibrahim Bbossa said that with the help of Non-intrusive inspection technology, URA is optimistic that wrong elements who involve themselves in smuggling will face the consequences in line with section 202 of the EACCMA.

He advised importers and exporters to work with URA in clearing their goods saying that Uganda Revenue Authority (URA) is a trade facilitator and is very open to help in clearance of goods.

“Do not opt for concealment/smuggling since it destabilizes the market and you pay a penalty once arrested. So, come to us if you have any challenges in trade and we plan together,” recommended Bbossa.